does maine tax retirement pensions

If you believe that your refund may be set-off. Call us toll free.

Pension Exemptions Benefit Wealthy Households And Compromise Resources Mecep

The figure below illustrates how a teacher pension is calculated in Maine.

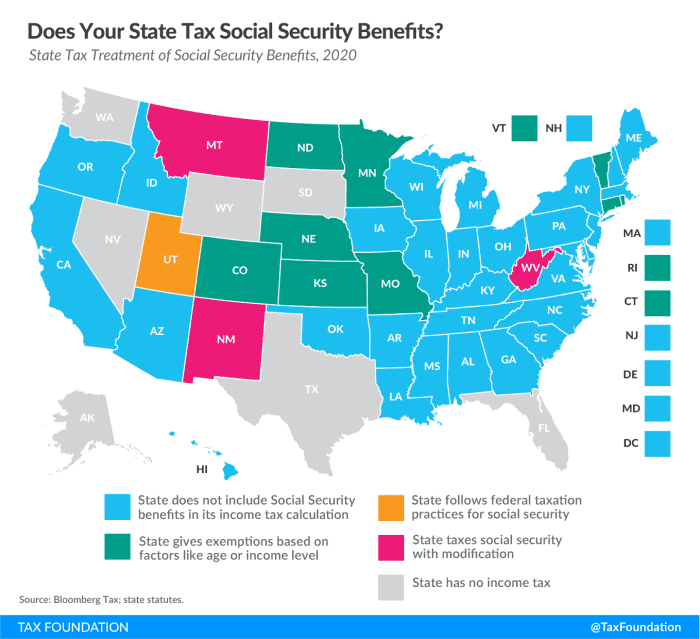

. Employer Self Service login. According to the Maine Department of Revenue Military pension benefits including survivor benefits will be completely exempt from the State of Maines income tax. However that deduction is reduced in an amount equal to your annual Social.

The Maine Public Employee Retirement System MPERS serves the public with sound retirement services to Maine governments. June 6 2019 239 AM. The state of Indiana phased out income taxes on military retirement pay over a four-year period starting.

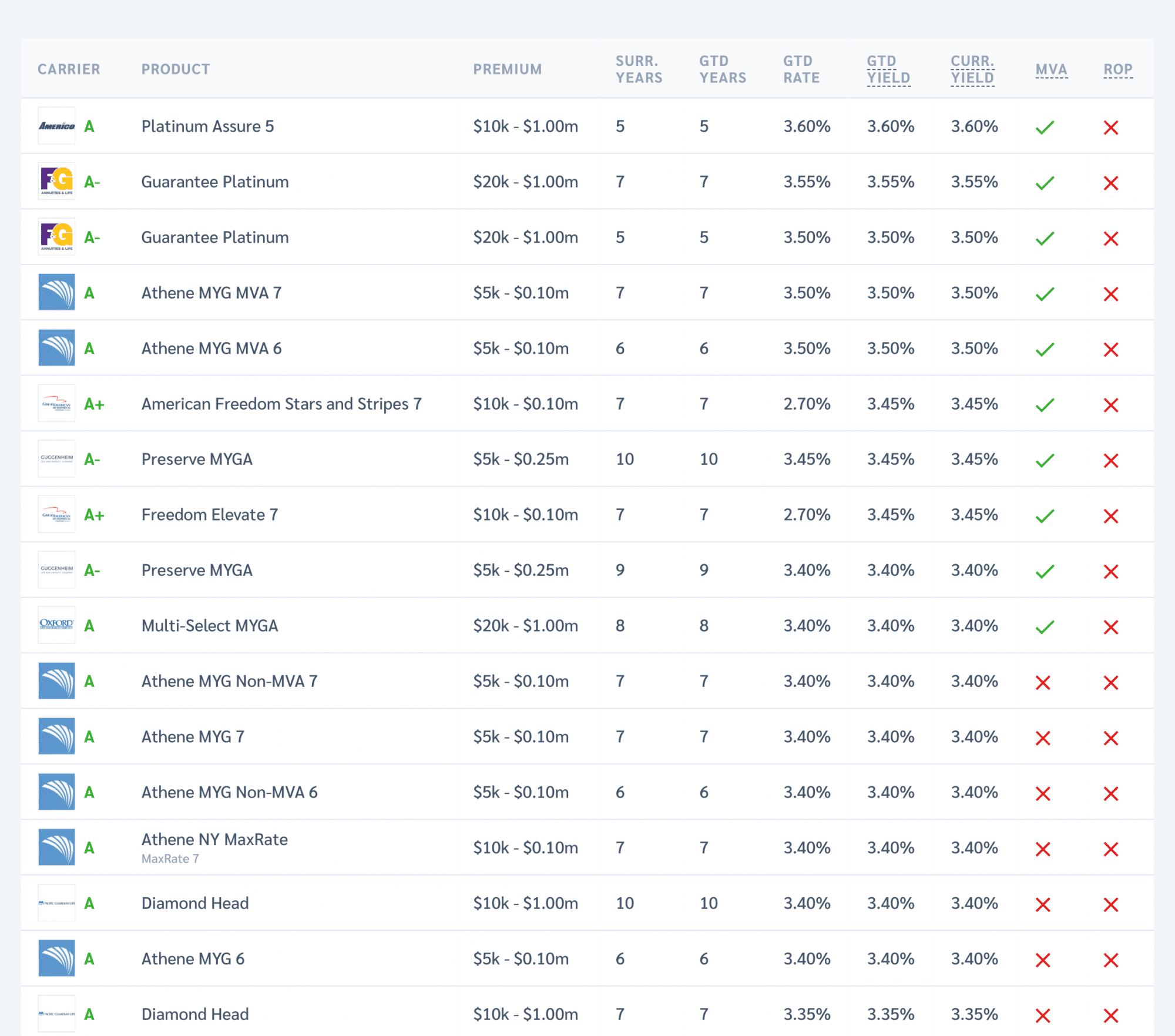

Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income. Subtract the amount in Box 14 from. Pension wealth is derived from a formula.

52 rows Exclusion reduced to 31110 for pension and annuity. If you file as part of a couple and earn a combined income of between 32000 and 44000 up to 50 percent of your benefits may be subject to taxation. See below Pick-up Contributions.

Military retirement pay is exempt from taxes beginning Jan. Maine Tax Breaks for Other Retirement Income. Maine allows for a deduction of up to 10000 per year on pension income.

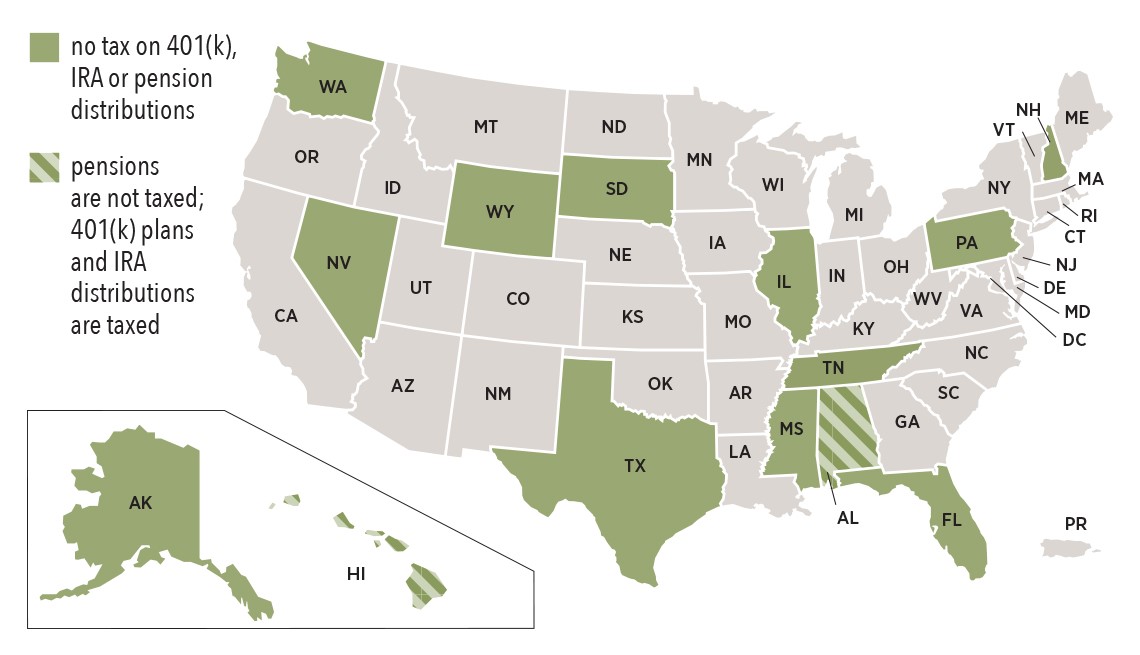

You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs 401 ks 403 bs. In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who received either a benefit payment or a. You will have to.

How Are Teacher Pensions Calculated in Maine. A manual entry will be made using the Maine State wages found in Box 14 of 1099-R. For more information call the Compliance Division of Maine Revenue Services at 207 624-9595 or e-mail compliancetaxmainegov.

Military pensions and Railroad Retirement benefits are fully exempt. The Pension Income Deduction. MA pensions qualify for the.

Over 65 retirement income exclusion up. No Tax on Mass Pensions. Alabama Alaska Florida Hawaii Illinois Michigan Mississippi Nevada New Hampshire Pennsylvania.

Maine Revenue Services processes the Income Tax Withholding Quarterly Return Form 941ME as well as the Unemployment Contributions Report Form ME UC-1. Taxes on Pension Income. In addition for Louisiana individual income tax purposes retirement benefits paid under the provisions of Chapter 1 Title 11 of the Louisiana Revised Statutes including.

In addition up to 25000 of other federally-taxed. The 10000 must be reduced by all taxable and nontaxable social. On the other hand if you.

States That Don T Tax Military Retirement Pay Discover Here

State Taxation Of Retirement Pension And Social Security Income Wolters Kluwer

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

Pros And Cons Of Retiring In Maine Cumberland Crossing

15 States That Don T Tax Retirement Income Pensions Social Security

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch

Retiring In Maine Vs New Hampshire Which Is Better 2021 Aging Greatly

12 States That Keep Retirement Dollars In Your Pocket Alhambra Investments

403b Tsa Annuity For Public Employees National Educational Services

Maine State Tax Guide Kiplinger

States That Don T Tax Retirement Income Personal Capital

Top 9 States With No Income Tax In 2020 Free Guide

Is Arizona State Retirement Income Taxable

Which States Are Best For Retirement Financial Samurai

7 States That Do Not Tax Retirement Income

States Compete For Military Retirees The Pew Charitable Trusts

State And Local Government Spending On Public Employee Retirement Systems Retirement Insight And Trends